Embark on a journey towards monetary well-being by harnessing the power of expert direction. Seasoned financial professionals can provide invaluable knowledge to navigate the complexities of your financial future. Build a meticulous plan that tackles your unique needs and aspirations. Concerning portfolio management to estate planning, expert guidance can enable you to make informed get more info options that enhance your financial well-being.

- Nurture a strong foundation of financial literacy.

- Seek professional guidance when needed.

- Periodically assess your financial plan and make realignments as circumstances change.

Unlocking Wealth Potential: Personalized Financial Guidance

Explore on a path towards prosperous freedom with tailored financial guidance. A seasoned advisor can help you formulate your objectives, evaluate your current situation, and develop a strategic plan to maximize your wealth.

Equip yourself with the knowledge to execute informed decisions and cultivate a secure financial future.

Building Your Future: Proven Financial Tools & Insights

Navigating the complexities of personal finance can appear daunting. Thankfully, there are effective strategies and solutions available to help you secure financial security. By following expert advice and implementing sound financial practices, you can create a solid foundation for your well-being.

- Start by creating budget to monitor your income and expenses. This will provide you valuable insights into your spending.

- Consider various investment strategies that align with your risk tolerance and financial goals. Diversification is key to mitigating uncertainty.

- Partner with an expert who can provide personalized advice based on your unique circumstances.

Remember, building financial security is a progressive process that requires patience, discipline, and informed decision-making. By implementing these strategies, you can pave the way for a more secure and fulfilling future.

Building a Solid Financial Foundation for Success

Laying the strongest financial foundation is essential for achieving long-term success. It involves developing good budgetary habits and implementing smart choices regarding your revenue. This includes tracking your outlays, preserving for emergencies, and investing wisely. A robust financial foundation provides security, allowing you to achieve your dreams while avoiding undue budgetary stress.

- Begin by creating a comprehensive budget that allocates your earnings to critical expenses, savings, and optional spending.

- Cut down on unimportant expenses to allocate more capital towards your financial goals.

- Explore different investment options that match your financial objectives.

Financial Portfolio Optimization: Maximizing Returns, Minimizing Risk

In the dynamic landscape of finance, strategic/calculated/diligent investment planning is paramount for individuals and organizations/institutions/businesses alike. A well-defined plan serves as a roadmap to attain/achieve/secure financial objectives/goals/aspirations, while mitigating/managing/reducing risk exposures. By carefully/meticulously/thoroughly evaluating market conditions, identifying/selecting/pinpointing suitable assets, and diversifying/spreading/allocating investments across various sectors, investors can enhance/maximize/amplify their returns/profitability/yield. A comprehensive plan should contemplate/include/encompass a long-term perspective, adaptability/flexibility/responsiveness to changing market dynamics, and regular/periodic/continuous portfolio reviews/assessments/evaluations. Ultimately/Ideally/Primarily, strategic investment planning empowers individuals to achieve/realize/attain financial success/well-being/prosperity.

Achieving Financial Well-being: Making Smart Choices for Success

True well-being isn't just about accumulating wealth; it's about achieving your goals and living a fulfilling life. Strategic planning are the cornerstone of financial wellness, empowering you to manage your finances. By exploring different strategies, you can create a personalized plan.

Cultivate a mindset of financial literacy by seeking expert advice. Develop good financial habits, such as tracking your expenses. Remember, financial wellness is a journey, not a destination. By being proactive, you can achieve lastingfreedom.

Jake Lloyd Then & Now!

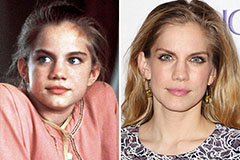

Jake Lloyd Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Joshua Jackson Then & Now!

Joshua Jackson Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now!